Cryptocurrency: The Future of Digital Finance

Cryptocurrency has emerged as one of the most revolutionary financial innovations of the 21st century. With the rise of decentralized digital assets, the global financial landscape is undergoing a significant transformation. This article explores the concept of cryptocurrency, its benefits, risks, and its potential future.

What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptographic techniques to secure transactions. Unlike traditional fiat currencies, cryptocurrencies operate on decentralized networks, typically powered by blockchain technology. This decentralized nature eliminates the need for intermediaries such as banks or financial institutions.

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency. Since then, thousands of alternative cryptocurrencies, including Ethereum, Ripple, Litecoin, and Cardano, have been developed, each offering unique functionalities.

How Cryptocurrency Works

Cryptocurrencies function through decentralized networks known as blockchains. A blockchain is a distributed ledger that records all transactions across multiple computers, ensuring transparency and security. Each transaction is validated by a process called mining, where complex mathematical problems are solved to confirm transactions and add them to the blockchain.

Most cryptocurrencies use a consensus mechanism, such as Proof of Work (PoW) or Proof of Stake (PoS), to validate transactions. These mechanisms ensure the integrity and security of the blockchain network.

Benefits of Cryptocurrency

1. Decentralization

One of the biggest advantages of cryptocurrency is decentralization. Since cryptocurrencies operate without a central authority, they reduce the risks of corruption, manipulation, and government interference.

2. Security and Transparency

Blockchain technology ensures high levels of security and transparency. Each transaction is recorded on a public ledger, making it nearly impossible to alter or tamper with transaction data.

3. Low Transaction Costs

Compared to traditional banking systems, cryptocurrency transactions often have lower fees. Cross-border transactions, in particular, benefit from reduced costs and faster processing times.

4. Financial Inclusion

Cryptocurrency provides financial services to people who lack access to traditional banking. Anyone with an internet connection can participate in the cryptocurrency economy, promoting global financial inclusion.

5. Potential for High Returns

The value of cryptocurrencies has seen significant growth over the years, attracting investors looking for high returns. Although volatile, many investors view cryptocurrencies as a lucrative investment opportunity.

Risks and Challenges of Cryptocurrency

1. Volatility

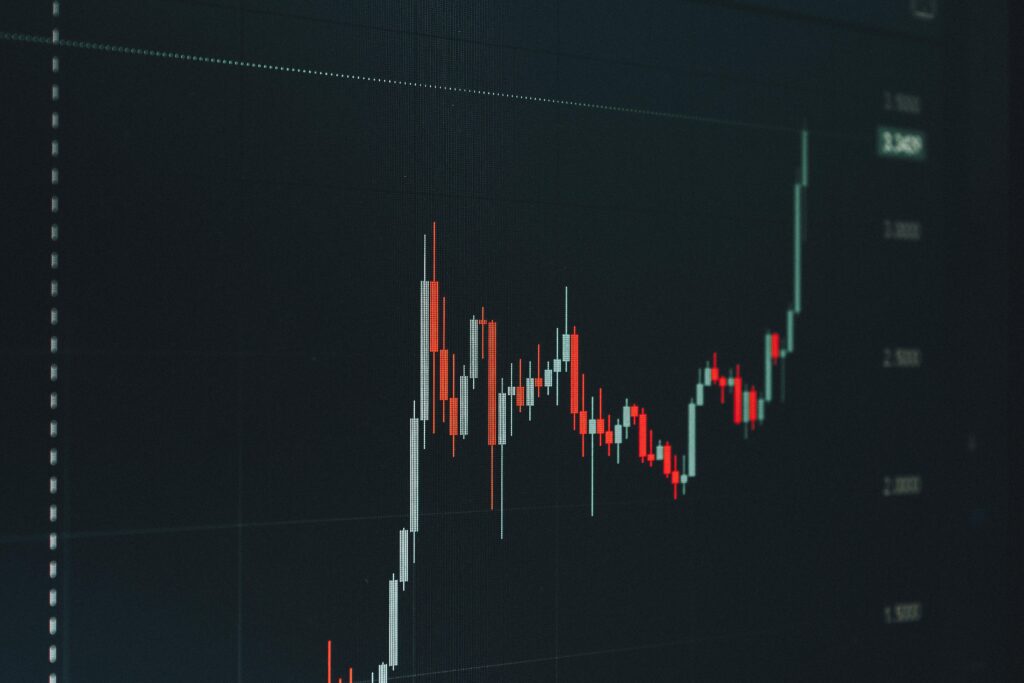

Cryptocurrency prices are highly volatile, with values fluctuating dramatically within short periods. This volatility can lead to substantial gains or losses for investors.

2. Regulatory Uncertainty

Governments and financial institutions around the world are still grappling with how to regulate cryptocurrencies. Changes in regulations can impact the value and legality of digital assets in different regions.

3. Security Threats

While blockchain technology is secure, cryptocurrency exchanges and wallets are vulnerable to hacking, phishing attacks, and fraud. Users must take precautions to protect their digital assets.

4. Scalability Issues

As cryptocurrency adoption increases, scalability becomes a concern. Some blockchain networks face limitations in processing large numbers of transactions quickly and efficiently.

5. Lack of Consumer Protection

Unlike traditional financial institutions, cryptocurrencies do not offer consumer protection measures. If funds are lost due to hacking or forgotten private keys, there is often no way to recover them.

The Future of Cryptocurrency

The future of cryptocurrency looks promising as adoption continues to grow. Governments and financial institutions are exploring ways to integrate digital currencies into mainstream finance. Central Bank Digital Currencies (CBDCs) are also being developed as a regulated form of digital currency.

Technological advancements such as Ethereum’s transition to Proof of Stake (PoS) and the development of Layer 2 scaling solutions aim to address existing challenges, making cryptocurrencies more efficient and sustainable.

Conclusion

Cryptocurrency has the potential to reshape the financial industry by providing a decentralized, secure, and efficient alternative to traditional banking systems. While challenges remain, the growing acceptance and integration of digital currencies suggest that cryptocurrency is here to stay. As the technology evolves, it will be exciting to see how cryptocurrency continues to impact global finance and innovation.ty